Asset Management Company

To cultivate asset formation and management that meets customers' needs, we will further strengthen our investment capabilities through selection and concentration attuned to the demands of the times, while enhancing our product lineup and provision of solutions. We will aim to grow the asset management business further by responding as part of a unified group, including long-term asset formation for individual customers that benefits from the support of the tax system for Nippon Individual Savings Accounts (NISAs) and individual-type defined contribution pension plans (iDeCo), and investment diversification needs including alternative investments for institutional investors.

Business overview

The company acts as part of a unified group to provide investment products and solutions that match the asset management needs of a wide range of customers, from individuals to institutional investors.

*Materiality areas:

- Declining birthrate and aging population, plus good health and lengthening lifespans

- Sound economic growth

- Environment and society

Strengths

- Asset Management One, our in-house asset management arm, characterized by strong investment capabilities and advanced sustainability initiatives

- Distribution network in and outside Mizuho group and robust support platform

- Providing solutions to institutional investors as a unified group

- Wide-ranging contact points with corporate clients through corporate pension scheme management and their employees as potential individual customers

Focuses

- Expand asset formation and asset management services for individual investors, and enhance investment performance

- Promote asset formation for individual investors through the pension business

- Bolster investment solutions and alternative investments capabilities that match the needs of institutional investors

Measures to achieve medium-term business plan

For individual customers, in addition to enhancing our investment capabilities, we will expand our product portfolio, including strategic products for the new NISA, through appropriate collaboration with our internal distribution network, ensuring our fiduciary duties. We will also support human capital enhancement for corporate clients and promote asset formation for individual customers through the pension business. Furthermore, we will develop and provide investment solutions addressing the needs of pension funds and other institutional investors, and strengthen our alternative investment capabilities.

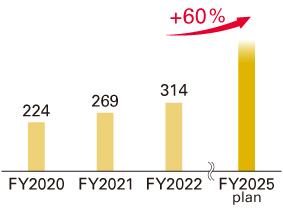

Publicly offered investment trust assets under management balance* (JPY trillion)

*Balance of publicly offered equity investment trusts excluding ETFs.

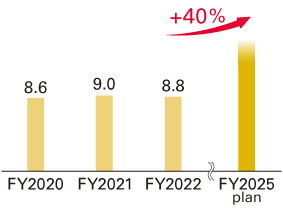

DB/DC pension assets under management balance* (JPY trillion)

*Total balance of assets in defined benefit (DB) and defined contribution (DC) pensions

(corporate and individual-type DC pensions)

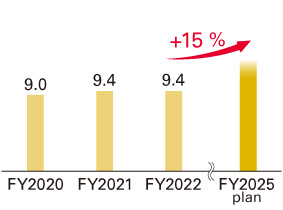

Number of individuals enrolled in iDeCo (thousand)