International Agreements

We participate in a variety of initiatives both in and outside Japan, from a global perspective and while taking into consideration our role as a financial institution, in an effort to promote activities aimed at forming a sustainable society.

UNEP Finance Initiative (UNEP FI)

Principles for Responsible Banking

Principles for Financial Action towards a Sustainable Society

Principles for Responsible Investment (PRI)

TCFD (Task Force on Climate–related Financial Disclosures)

Partnership for Carbon Accounting Financials (PCAF)

Net-Zero Banking Alliance (NZBA)

Taskforce on Nature-related Financial Disclosures (TNFD) Forum

Cross Sector Biodiversity Initiative (CSBI)

Net Zero Asset Managers initiative

The Human Capital Management Consortium

United Nations Global Compact

The United Nations Global Compact came into existence in July 2000 with the endorsement of Kofi Annan, who was then the UN's Secretary-General. Through ten principles addressing matters like human rights, labor, the environment, and anti–corruption, the UN Global Compact encourages companies and other organizations throughout the world to support and act in ways consistent with the ten principles. Mizuho signed on as a supporter of the UN Global Compact in 2006.

By participating in activities such as the SDG- and ESG-related working groups of the Global Compact Network Japan (a local network promoting the UN Global Compact in Japan), we are sharing information and views on the advancement of sustainability initiatives.

The Ten Principles of the United Nations Global Compact

Human Rights

Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and

Principle 2: make sure that they are not complicit in human rights abuses.

Labour

Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

Principle 4: the elimination of all forms of forced and compulsory labour;

Principle 5: the effective abolition of child labour; and

Principle 6: the elimination of discrimination in respect of employment and occupation.

Environment

Principle 7: Businesses should support a precautionary approach to environmental challenges;

Principle 8: undertake initiatives to promote greater environmental responsibility; and

Principle 9: encourage the development and diffusion of environmentally friendly technologies.

Anti–Corruption

Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery.

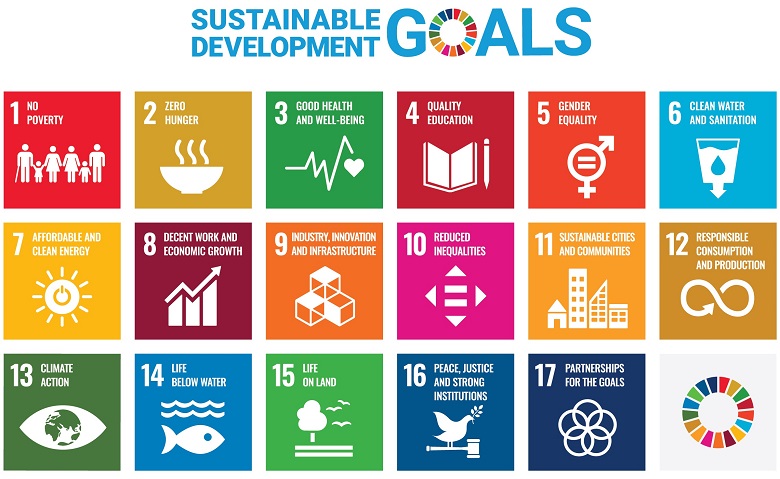

Sustainable Development Goals (SDGs)

UNEP Finance Initiative (UNEP FI)

The United Nations Environment Programme Finance Initiative (UNEP FI) is an international partnership of financial institutions that strives to identify, disseminate, and promote the best environmental and sustainable practices in the various operations in which financial institutions are involved. Mizuho became a signatory to the UNEP FI in 2006.

Principles for Responsible Banking

The Principles for Responsible Banking are a framework aiming for the sustainable development of banks and society in alignment with the objectives of the Sustainable Development Goals (SDGs) and the Paris Agreement. The Principles enable banks to identify where they have the potential to make the most significant positive and negative impacts, and provide a framework for banks to set and work towards strategies and targets in line with initiatives in these identified areas, and to be transparent in their disclosures.

The Principles for Responsible Banking are a framework aiming for the sustainable development of banks and society in alignment with the objectives of the Sustainable Development Goals (SDGs) and the Paris Agreement. The Principles enable banks to identify where they have the potential to make the most significant positive and negative impacts, and provide a framework for banks to set and work towards strategies and targets in line with initiatives in these identified areas, and to be transparent in their disclosures.

Mizuho signed the Principles for Responsible Banking when they were launched in September 2019.

Mizuho signs Principles for Responsible Banking (PDF/54KB)

Mizuho’s reporting and self-assessment for the Principles for Responsible Banking (PDF/1,629KB)

Principles for Financial Action towards a Sustainable Society (Principles for Financial Action for the 21st Century)

In 2010, the Expert Committee on Environment and Finance of the General Policy Committee of the Japan Ministry of the Environment Central Environment Council recommended the development of a Japanese version of the principles for financial action for the environment, as a framework for expanding environmental finance initiatives.

This resulted in efforts to create such a code of conduct, with the aim of expanding the scope and improving the quality of environmental finance in Japan.

The drafting committee, for which the Ministry of the Environment served as secretariat, held discussions across seven meetings beginning in September 2010, and the Principles for Financial Action towards a Sustainable Society (Principles for Financial Action for the 21st Century), which address a wide range of issues including environmental challenges, were set forth in October 2011.

As a member of the drafting committee and working group, Mizuho actively participated in discussions for the formulation of the principles and sector guidelines, and became an official signatory in November 2011.

Mizuho Bank became a signatory in April 2018.

Equator Principles

Mizuho Bank (formerly Mizuho Corporate Bank) recognized early on that the Equator Principles would become a new business standard in international financing for environmental and social risk management in large–scale projects and therefore became the first Asian bank to adopt the Equator Principles in October 2003. Taking advantage of our long experience of implementing the Equator Principles in project finance, we now play a leadership role among Equator Principles Financial Institutions as a member of the Steering Committee.

Initiatives for the Equator Principles

Principles for Responsible Investment (PRI)

Mizuho Trust & Banking and Asset Management One have signed on to the UN Principles for Responsible Investment (PRI), which ensure that institutional investors, pension funds, and other stakeholders incorporate environmental, social, and corporate governance issues into their decision–making processes for investment.

Mizuho Trust & Banking and Asset Management One both received A+ ratings in all categories in 2020.

Task Force on Climate–related Financial Disclosures (TCFD)

The Task Force on Climate-related Financial Disclosures (TCFD) is a task force led by representatives of the private sector, established in December 2015 based on recommendations from the Financial Stability Board in order to enhance the availability of corporate information related to climate change. It issued its final report in June 2017. Mizuho supports the intent and aims of the Recommendations of TCFD and will conduct initiatives based on the TCFD framework to work toward more advanced disclosure.

Partnership for Carbon Accounting Financials (PCAF)

Partnership for Carbon Accounting Financials (PCAF) is a global, industry-led initiative that enables financial institution to measure and disclose the indirect greenhouse gas (GHG) emission of their loans and investments.

Mizuho Financial Group has become the first Japanese financial institution to join PCAF in 2021. This is also in line with our policy of positively contributing to the achievement of a low-carbon society (achievement of net-zero GHG emissions) by 2050 and of undertaking transformation to a portfolio aligned with the targets in the Paris Agreement.

Net-Zero Banking Alliance (NZBA)

NZBA is an alliance of a global group of banks committed to aligning their lending and investment portfolios with net-zero emissions by 2050.

Mizuho Financial Group joined the NZBA in October 2021.

Mizuho joins the Net-Zero Banking Alliance international initiative

Climate Action 100+

Climate Action 100+ is an initiative led by global investors to engage companies that are large emitters of greenhouse gases worldwide.

Asset Management One has participated in the initiative since its establishment in December 2017. Because climate change is a global issue, we believe that coordinating global resources is essential. Our ESG analysts in Tokyo and our analysts at offices outside Japan work together on the initiative.

CDP Climate Change Program

CDP is an international NPO that provides companies and investors with a global system to measure, disclose, manage, and share vital environmental information.

In 2005, Mizuho Financial Group joined a project run by the CDP and institutional investors, which calls for companies to disclose both their strategies for addressing climate change and their greenhouse gas emissions. Mizuho Financial Group has also been participating in a project that calls for water–related disclosures since fiscal 2010.

Climate Bonds Initiative

The Climate Bonds Initiative is an investor-focused international NPO, based in London, working solely to mobilize the USD100 trillion bond market for climate change solutions. CBI promotes large-scale investment in projects and assets necessary for a rapid transition to a low-carbon and climate resilient economy.

The Climate Bonds Initiative is an investor-focused international NPO, based in London, working solely to mobilize the USD100 trillion bond market for climate change solutions. CBI promotes large-scale investment in projects and assets necessary for a rapid transition to a low-carbon and climate resilient economy.

Mizuho Securities has entered into a partnership agreement with CBI to enhance its expertise in environmental finance.

GX League

Green Transformation (GX) League is a forum in which a group of companies proactively aiming for green transformation will work with other parties pursuing green transformation in the government, academic, and economic spheres to discuss the transformation of the overall economic and social system and to create new markets.

Mizuho Financial Group signed the Green Transformation (GX) League Basic Concept in March 2022.

Mizuho endorses the GX League Basic Concept

Taskforce on Nature-related Financial Disclosures (TNFD) Forum

The TNFD is an international initiative to develop and provide a framework for disclosing nature-related financial information. Following nine months of preparation by an informal working group, the initiative was officially launched in June 2021 by the United Nations Environment Program Finance Initiative (UNEP FI), the United Nations Development Program (UNDP), Global Canopy, and the World Wildlife Fund (WWF).

Mizuho Financial Group and Mizuho Research & Technologies support the TNFD principles and have been participating in the TNFD Forum since March 2022 to promote environmental initiatives and assist in establishing a framework for disclosing nature-related financial information.

Mizuho joins the Taskforce on Nature-related Financial Disclosures Forum

Cross Sector Biodiversity Initiative (CSBI)

Mizuho Bank, as an early member, is actively involved in the Cross Sector Biodiversity Initiative (CSBI), a partnership among the Equator Principles Association, IPEICA, and the International Council on Mining and Metals (ICMM). CSBI considers measures and strategies to reduce the impact of large–scale development projects on biodiversity.

Mizuho Bank, as an early member, is actively involved in the Cross Sector Biodiversity Initiative (CSBI), a partnership among the Equator Principles Association, IPEICA, and the International Council on Mining and Metals (ICMM). CSBI considers measures and strategies to reduce the impact of large–scale development projects on biodiversity.

Initiatives for Preserving Biodiversity

Net Zero Asset Managers initiative

The Net Zero Asset Managers initiative is an initiative by global asset management companies to achieve net zero greenhouse gas emissions.

Asset Management One has participated in the initiative since its launch in December 2020 and is committed to contributing to reducing greenhouse gas emissions to net zero by 2050 and joining worldwide measures to hold the increase in the global average temperature to well below 2°Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°Celsius above pre-industrial levels.

30% Club Japan

The 30% Club Japan campaign aims to increase the ratio of women in important decision-making bodies of companies.

Mizuho Financial Group endorsed and joined the 30% Club Japan in July 2021.

Mizuho joins the 30% Club Japan

The Human Capital Management Consortium

The Human Capital Management Consortium was established with the objective of promoting human capital management in Japanese companies in terms of practice and disclosure.

Mizuho Financial Group and Asset Management One joined the Consortium at its launch in August 2022.

ESG Disclosure Study Group

The ESG Disclosure Study Group carries out research related to ESG information disclosure with the goal of establishing harmony between the sustained development of society and the individual efforts of companies to enhance corporate value and growth.

Mizuho Financial Group has been taking part in the study group at its establishment in June 2020, and Mizuho Bank, Mizuho Trust Bank, and Mizuho Research & Technologies joined in July 2022.